Economists trying to devise a development strategy at the end of second world war took an account of dependence of almost all developing countries on exports of primary products. Prebisch among others argued that exports of primary goods would not lead to development. Due to low-income and price elasticities of demand expansion in exports of primary goods would not lead corresponding increase in export revenue as prices will decline. Import payments, on the other hand, would continue to rise as the demand for capital goods would be high in order to raise growth, because developing countries don’t produce capital goods would lead to deterioration in terms of trade and worsening BOP deficit when they try to increase the growth. The increase in BOP deficit would force the developing countries to cut back the investment and hamper the growth. Since developing countries could not be based their growth on exports of primary goods it was necessary to base development on industrialization. A further argument as given by Rosenstein-Rodan in favor of industrialization in over-populated countries. He said since these countries suffer from low labor productivity due to land pressure and future prospects in agriculture are very limited and risky, industrialization is the only way to absorb the surplus labor force.

Keynes, Marx and the effect of QE

One of the interesting sessions at last weekend’s Historical Materialism conference (apart from my session, of course) was one on the work of Suzanne de Brunhoff. Brunhoff was a Marxist economist from the 1970s onwards who specialised in Marx’s theory of money and applying it to the conditions of modern capitalism. She died this year. There is no space to deal with her contributions here. What I want to take up from the session was a presentation by Maria Ivanova of Goldsmiths University, London. Ivanova made some key observations about Marx’s theory of money, but also of Keynes. She pointed out that, in his Treatise on Money written in 1930 at the start of the Great Depression, Keynes argued that central banks would have to intervene with what we now call ‘unconventional monetary policies’ designed to lower the cost of borrowing and raise sufficient liquidity for investment. Just trying…

View original post 1,914 more words

The next recession

Back last summer, there was growing concern that the world economy, already making the weakest recovery from the deepest slump in production and investment since 1945, was slowing down.

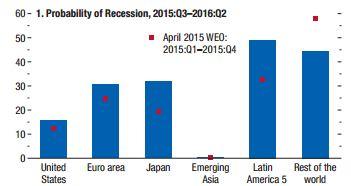

Indeed, it now seemed that the ugly thought of another recession, as economists call a contraction in production, incomes and spending, was a serious possibility within a few years or less. The IMF raised the probability of recession in the so-called ‘emerging economies’ of Latin America, ex-China Asia and the rest of the world to near 50%.

The slowdown in emerging economies has been led by the significant slowdown in China’s powerhouse economy, from double-digit real GDP growth just a few years ago to less than 7% now on the official figures (many ‘experts’ reckon real GDP growth is much lower than that). As China slowed, its inexorable demand for energy and other raw materials and other export goods from elsewhere…

View original post 1,639 more words

The U.S. Dollar: The Modern Day Bancor

Macroeconomic Theory and Operational Reality

8 Financial Experts That Are Warning That A Great Financial Crisis Is Imminent

Nothing has changed since 2008

8 Financial Experts That Are Warning That A Great Financial Crisis Is Imminent

Nothing has changed since 2008

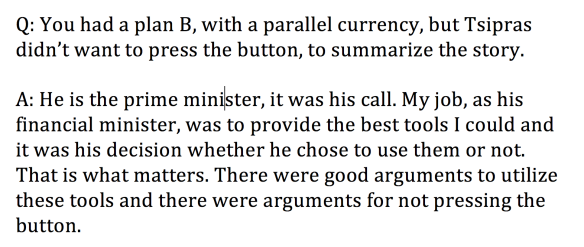

In conversation with El Pais (Claudi Pérez), the complete (long) transcript

Claudi Pérez, of El Pais, inteviewed me in our Athens apartment last week. Here is the article that emerged recently in El Pais. The complete, unedited, transcript (in English) follows:

View original post 4,525 more words